You have a strong talent for numbers as well as an interest in finance. You may imagine yourself on Wall Street. Prestigious, glamorous, and cut throat. These are the terms that come to mind when we think of investment banking based on glamorous film portrayals, but what is the reality? You stumble onto the career of an actuary. You have a general idea of what it requires, but it is its consistent high placement on best job lists that catches your attention.

Explore Now : https://theacademicjunction.co.in/

Understanding the Work: Actuary vs Investment Banking

Fundamentally, actuaries and investment bankers base their choices on mathematical and financial analysis. Both occupations necessitate excellent academic and analytical abilities, as well as effective communication skills when interacting with clients. However, when we go deeper into what they are analyzing and what they do with this data, we can see how they differ. Investment bankers typically work for an investment bank or investment banking department within an organization.

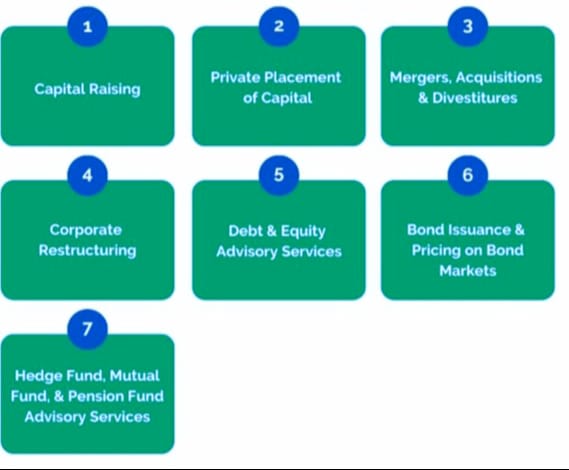

They are engaged in a variety of financial advice operations for corporate clients:

Investment Bankers Financial Advisory Activities

Fundamentally, actuaries and investment bankers base their decisions on mathematical and financial analysis. Both careers require strong academic and analytical ability, as well as outstanding communication skills when dealing with clients. However, when we dig deeper into what they’re studying and what they do with the data, we can see how they differ.

Investment bankers usually work for an investment bank or an investment banking department within a company. They are engaged in a variety of financial advisory operations for corporate clients :

EMERGING FIELDS FOR ACTUARIES

All You Need To Know About Actuarial Science | The Academic Junction | By Silky Goyal

Work-Life Balance and Stress: Comparing Actuaries and Investment Bankers

“The sleep deprivation, the treatment by senior bankers, the mental and physical stress … I’ve been through foster care and this is arguably worse.”

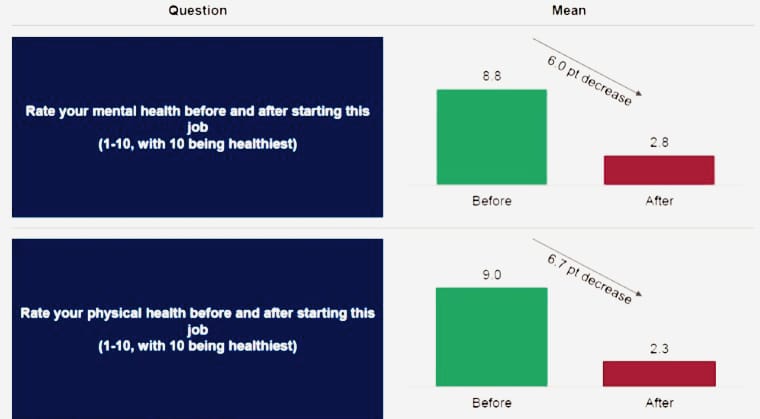

An analyst from Goldman Sachs made a powerful statement. It emphasizes the harsh conditions faced by investment bankers. A poll of these analysts at Goldman Sachs yielded astonishing results that may change your outlook from glamorous to demanding. Working an average of 98 hours per week, an analyst stated, “What is not acceptable to me is 110-120 hours per week!

The arithmetic is simple: that leaves 4 hours each day for eating, sleeping, showering, restroom use, and general transition time. This goes beyond the definition of ‘hard work’; it is brutal and abusive.” It is unsurprising that these conditions would have a negative impact on someone’s health. The graphic below is drawn from a Goldman Sachs poll. It is unacceptable for a work to have even a minor affect on your mental health, let alone to such an extent.

It is important to note that this study only included 13 Goldman Sachs workers. This is a small sample size, and the conditions may not be common. Unfortunately, it appears to be common.

In addition to working long hours and having a terrible work-life balance, investment bankers are highly stressed. Dealing with the strain requires a certain personality type. The profession is fast-paced, with high expectations, deadlines, and a constant pressure to surpass colleagues. Why would anyone want this lifestyle? Some thrive in this environment, which demands constant challenge and excitement. It resembles a game and may be compared to sports. Why spend hours training? For a thrill. The drive to succeed, the competitiveness, and the thrill of hitting that goal are all similar to closing a deal.

If you value work-life balance, becoming an actuary is surely more appealing. In 2017, it ranked first for employment with minimal stress and high compensation. Maintaining a work-life balance is certainly possible when working 40-50 hours a week. Although these may be extended during busy periods like as the end of the year or for specific projects, they are vastly different from investment banking.

The job’s pressure varies by sector, but the common view is that it is low stress, especially when compared to its finance rivals. The work is more predictable, with substantially less rivalry among peers. To many people (including myself), this sounds like heaven; nevertheless, if your brain is wired like an investment banker, it may appear dull.

Enroll for Actuarial Science Courses : https://theacademicjunction.co.in/combo-courses/

The Journey to the Profession: Actuary and Investment Banking Paths

What has been mentioned about work-life balance makes actuary seem like the ideal choice, but we are overlooking one critical aspect of being an actuary. The examinations. As shown here, becoming a fully qualified actuary is not straightforward. You will have many difficult tests ahead of you. This will necessitate a strong commitment and willingness to learn for a long time, as they take years to complete.

This is where the gap between actuaries and investment bankers’ spare time narrows. These tests are completed in addition to full-time job, increasing the weekly hours spent to your career significantly.

Both actuaries and investment bankers can frequently get a job with only a bachelor’s degree. However, investment banking can become more competitive. Actuarial science degrees are growing increasingly popular, but they are still quite uncommon. Only 40 of the UK’s 164 universities offer actuarial degree programs. This means that actuarial students are in high demand and should have no trouble finding work. There is no specialized degree program for investment banking, so you can enter the field with a variety of degrees, including Finance, Business, and Economics. Almost every university in the UK offers one or more of these degrees, usually with much larger courses than actuarial science.

As a result, if you want to work for one of the most well-known and recognized investment banks, you’ll face stiff competition. This pushes some people to pursue master’s degrees in order to gain an advantage, hence lengthening the path to success.

Although the investment banking route does not require substantial exams, long hours will be required regardless of whether they are spent working or studying. However, with actuary, there is an end goal in sight; these lengthy hours of studying will be over once you become a fellow. The same cannot be said for investment banking.

Salary and Job Security in Actuary and Investment Banking Careers

Investment bankers may have chosen their profession because they are highly driven thrill seekers, but what is their primary motivation? Money! Both actuarial and investment banking are rewarding jobs, but investment banking offers significantly higher earnings. Although earnings vary by location, an actuary with extensive experience can expect to make between £70,000 and £110,000, whereas an experienced investment banker’s base income ranges from £150,000 to £165,000.

While investment banking offers an edge, what truly distinguishes it are the massive bonuses, which can nearly treble the pay. Some people believe that money makes the world go round. If this is your primary incentive in life, investment banking is the place to be! But, at what cost?

You studied hard at university and are now working in your ideal job; how secure do you feel? Job security is influenced by a variety of circumstances, thus we cannot provide a precise answer. Overall, actuaries are commended for their great job stability. It is an exceedingly specialised field with a higher demand than the number of actuaries available. Furthermore, fields such as insurance are relatively stable. The demand will exist regardless of economic conditions.

That being said, economic difficulties can create possibilities. In times of financial hardship, businesses may turn to investment banks for assistance and direction. Of course, in times of growth, they would be well compensated for the transactions they undertake.

Exploring Exit Options: Actuary vs Investment Banking

You’ve gone down your chosen path and discovered it’s not for you. Are you trapped, or can it open new doors? Both are highly respected jobs, thus there are several prospects for both. Investment banking, on the other hand, offers a wider range of opportunities.

The opportunities in the world of finance are far greater than those in insurance. Furthermore, this employment provides exposure to a wide range of industries, making them perfect prospects for developing a comprehensive skill set. These professional opportunities include:

Conclusion: Making the Right Career Choice

Both investment banking and actuarial science are high-risk, high-reward careers, with investment banking being the more extreme example. Although the day-to-day duties vary, the fundamental analytical and quantitative abilities required to succeed in any career are comparable.

Both vocations have been thoroughly examined, and the benefits and drawbacks differ depending on whatever element you consider. The tremendous intensity and stress of investment banking pays off handsomely, with excellent wages and career paths. Actuarial science will allow you to live a more secure and predictable life while still earning a considerable wage. Higher job stability allows you to enjoy life outside of work more freely and relax more.

Ultimately, both courses will take you to profitable and rewarding positions. The decision is ultimately determined by your personality type. What are your interests? Which areas of life do you cherish the most? Where will you thrive and find happiness?

Visit Now : https://theacademicjunction.co.in/