Do you enjoy working with numbers? Do you want to work in mathematics or statistics? If you answered yes to these questions, then becoming an actuary is the right path for you.

Actuaries are among the most well-known and respected financial experts. They aid businesses in assessing risks and making more informed decisions. This article will shed light on the typical actuary salary in India, allowing you to see how lucrative a career in this sector can be.

We’ll also discuss how you may improve your chances of landing the highest-paying job in this industry. Continue reading to learn more:

What is the Average Actuary Salary in India?

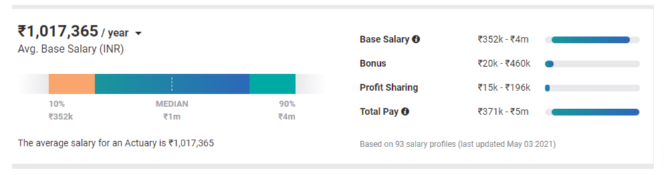

In India, the average actuary income is INR 10.11 lakh per year. Pay in this sector ranges from INR 3.5 lakh per year to INR 50 lakh per year, based on a variety of things such as your experience and skills.

Also Read :https://theacademicjunction.co.in/salary-of-an-actuary-in-india/

This role’s bonuses range from INR 20,000 to INR 4.6 lakh per year, with shared profits ranging from INR 15,000 to INR 1.96 lakh per year. It is without a doubt one of the most lucrative occupations available to data science and mathematics specialists.

Companies rely on actuaries to evaluate risks and get insights to make better decisions, making them one of the evergreen professions. It is one of the most well-known professions in the financial sector and is unquestionably a rewarding career path to take.

From huge corporations to financial institutions, all want actuarial professionals to assist them in making better business decisions. If you desire a highly competitive career with several prospects for advancement, you should become an actuary.

What Does an Actuary Do?

An actuary is in charge of assessing data from past and present events in order to forecast the likelihood of future events. They must assess the possibility of various events and devise strategies to mitigate the risk to which their firm is exposed.

Actuaries must analyze the various risks that their firm faces in order to make better judgments. They employ predictive analysis and financial modeling to forecast the possible financial costs of various situations.

They operate in a variety of areas of business, including insurance premium planning, financial investment management, and pension plan calculation. Most actuaries work for insurance firms, assisting them in determining the risks of a specific plan. Other industries in which they may be found include investment management, corporate finance, consulting, healthcare, and banking.

They are crucial in both growing and established commercial domains. Actuaries are an essential part of a company’s strategic decision-making and planning, which is why this position is always in great demand.

Must Read :https://theacademicjunction.co.in/who-is-an-actuary/

Because they must review vast amounts of data linked to trends and costing, they rely heavily on statistical analysis. Actuaries in insurance firms strive to strike a balance between the risk of providing policies and the financial risk the company bears as a result of such policies.

They employ data models to analyze the impact of various elements on an insurance policy, such as event data, and then alter the policy’s premiums and conditions accordingly. Actuaries typically work in a standard office setting during normal business hours.

Factors Affecting the Average Actuary Salary in India

Your actuary salary in India is affected by a variety of things. You should be aware of the impact of these aspects so that you may assess your earning potential in this sector and plan your career accordingly.

Understanding the impact of these aspects can also assist you in determining how to enhance your actuary pay in an efficient and effective manner. The following are the most important things that influence your actuary pay in India:

- Your experience

- Your expertise (skills)

- Your location

In the following sections, we’ll explain how each of these criteria works so you can quickly predict how much you may earn in this industry:

Our Learners Also Read : https://theacademicjunction.co.in/actuarial-science-career-prospects-in-india/

Experience

The amount of experience you have as a professional is perhaps the most important factor that influences your actuary salary in India. The more experience you have in this field, the more money you will make.

Early-career actuaries earn 35% less than the industry average, while entry-level actuaries earn 18% less. Mid-career actuaries, on the other hand, earn 38% more than the average, while late-career actuaries earn 192% more.

Actuaries with less than a year of experience earn an average annual salary of INR 6.6 lakh (including bonuses, overtime pay, and commission). Similarly, an actuary with one to four years of experience earns an average of INR 8.26 lakh a year. Actuaries with five to nine years of experience earn INR 14 lakh per year on average, while those with ten to nineteen years of experience earn INR 30 lakh per year on average.

Skills

Actuaries are highly specialized professionals who must be fluent in a variety of mathematical, statistical, and data science principles. As a result, the talents you possess have a significant impact on your actuary pay in India.

You should consider the talents required for this profession in two ways. To begin, there are prominent skills that will ensure you can easily find a decent company and remain in demand. Second, there are skills that are in high demand and pay much over average. Some skills fall under both of these categories, but the majority of them do not.

Financial Modeling, Insurance, Pricing, Data Analysis, and Statistical Analysis are the most prominent skills among actuaries. Having these skills will ensure that you may begin your career in this industry with ease.

Financial Analysis is the ability that pays the most for actuaries in India. Actuaries who possess this expertise earn approximately 59% more than the average. Other notable skills with above-average salary are:

- Financial Modeling (53% more than the average)

- Pricing (43% more than the average)

- Microsoft Excel (24% more than the average)

- Insurance (19% more than the average)

- Data Analysis (11% more than the average)

Developing these skills will help you get high-paying jobs in the industry and become an in-demand actuary.

Location

The location in which you work is another important element in deciding how much you will earn as an actuary in India. Because the cost of living varies by city, actuaries are paid differently in each.

Some cities are prohibitively expensive to live in, while others are moderately priced. However, this is one of the issues over which a person has the least control. Nonetheless, understanding how your location influences your actuary salary in India will help you determine how much you may expect to earn in this industry.

Mumbai (38% more than the national average), Bangalore (19% more than the national average), and Hyderabad (9% more than the national average) all offer above-average compensation. On the other side, some cities pay less than the national average. Chennai (36% lower than the national average), Pune (16% lower than the national average), and Delhi (23% lower than the national average) are among them.

How to Get the Best Actuary Salary in India

An actuary’s salary might reach INR 50 lakh per year, which is a substantial sum. If you want to earn such high compensation, you should focus on learning the most in-demand talents and become a sought-after industry expert.

The competence you have is the most controllable of the three elements that influence your actuary compensation in India. You may easily start a career in this industry and ensure that you acquire the highest-paying roles by developing the most in-demand talents.

Must Watch : https://www.youtube.com/live/u6OQh3HOKeo?feature=share

The Role of Education and Certification in Determining Actuarial Science Salary

Education and certification are essential variables in defining the pay environment for actuarial science in India. Actuaries must have a good foundation in mathematics, statistics, and finance, therefore their educational background is a key factor in determining their earning potential.

In India, ambitious individuals frequently earn a bachelor’s degree in statistics, math, economics, or a related area in order to pursue a career in actuarial science. Many professional actuaries additionally have postgraduate degrees, such as a master’s or doctorate, which can broaden their knowledge and open doors to higher-paying careers.

In addition, professional qualification has a significant impact on actuarial compensation. The most widely recognized distinction is that of Fellow of the Institute of Actuaries of India (FIAI) or Fellow of the Actuarial Society of India (FASI). Achieving fellowship rank implies a high level of competence and skill in the profession, which often leads to increased earning potential.

Actuaries who spend in their education on a regular basis, such as by pursuing advanced certifications or remaining current with industry trends through workshops and seminars, are more likely to command better pay. These additional certifications are generally valued by employers because they contribute to an actuary’s ability to give reliable risk assessments and financial forecasts.

Navigating the Career Trajectory for Optimal Actuarial Science Salary

The direction of an actuary’s career path has a large impact on their income potential. Actuaries in India typically begin as trainees or entry-level analysts, working their way up the corporate ladder as they gain experience and polish their skills. Understanding the various stages of a normal actuarial career can help one optimize their income over time.

Entry-Level Positions: Professionals who are new to the actuarial field generally begin their careers as trainees, junior analysts, or assistant actuaries. While the starting income may be low, this phase provides an opportunity to get valuable practical experience and a solid foundation in actuarial ideas.

Mid-Level Roles: Actuaries can advance to mid-level roles such as senior analysts or associate actuaries after gaining a few years of experience. At this point, their remuneration begins to reflect their expanding experience and contributions to the organization. Actuaries who have broadened their skill sets and proved their ability to handle difficult scenarios are more likely to command better pay.

Senior Management and Leadership Roles: Seasoned actuaries with strong analytical and leadership skills can advance to high management positions such as Chief Actuaries, Risk Managers, or Vice Presidents. As they involve directing crucial strategic choices and managing teams of actuaries, these positions come with much higher compensation and additional benefits.

Consulting and Specialization: Because of the shortage of professionals in these fields, actuaries who specialize in specialty areas such as healthcare, pensions, or investments frequently have better earning potential. Furthermore, some actuaries move into consulting roles, offering their expertise to many clients or companies, which can lead to higher pay.

Watch Demo Videos : https://theacademicjunction.co.in/actuarial-science-demo-lectures/

Conclusion

Many people aspire to be actuaries. While everyone wants to be an actuary, not everyone knows how to make the most money in this area. We are confident that the knowledge in this post will help you progress in your profession and prepare for a more prosperous career.

The Academic Junction provides you best Actuarial Science Courses with all related subjects and the best placement assistance with Doubt solving sessions. Also, you can learn with India’s leading faculties & grab scholarships.

Take Counselling : https://theacademicjunction.co.in/counselling/