Why CM1 from The Academic Junction??

Experienced corporate faculties with 13-14 exams cleared to make you understand the application of knowledge contained in the subject.

Classes available in all 3 modes- Classroom, Live Online and Videos.

Multiple small batches to focus on personal interaction and development.

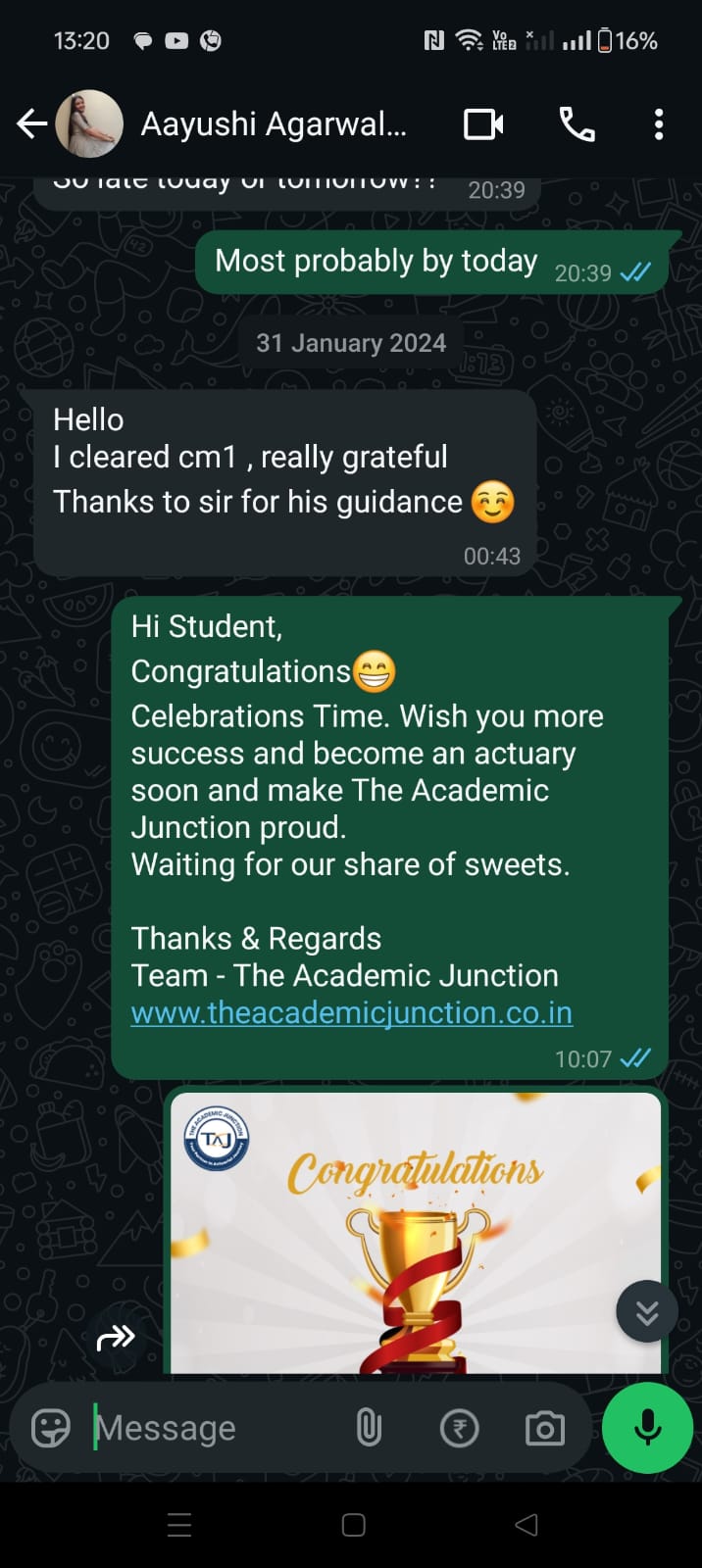

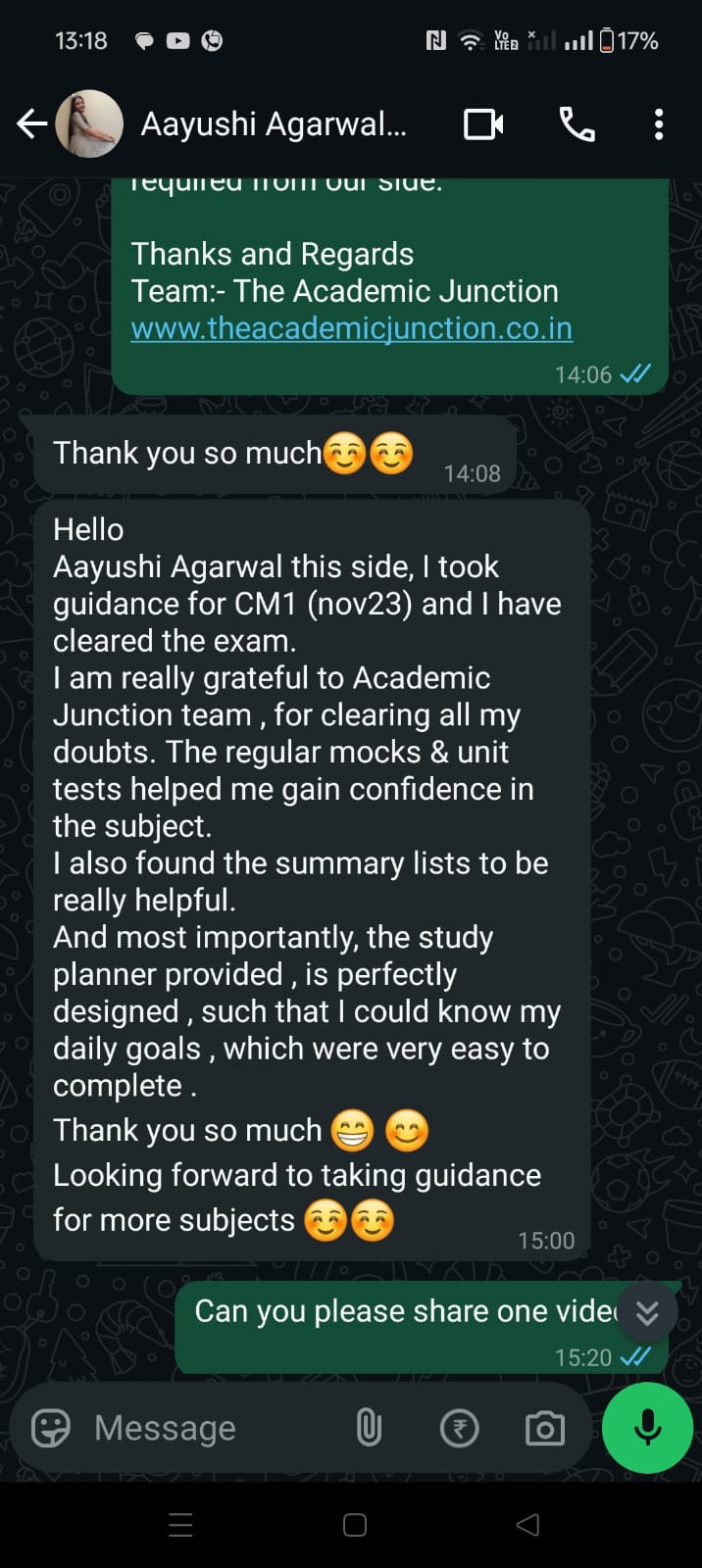

Regular Assessments and feedback sharing to discuss your improvement areas.

Detailed Study plan, Chapter Wise Important Topics Detailed description- main highlights.

Exclusive writing and discussion sessions oriented to past papers discussion.

Regular doubt classes to help you learn technical skills and clear your conceptual knowledge.

Regular contacts with companies and start-ups so as to share your resume and prepare you accordingly for interviews.

CM1 Course Content

Actuarial Mathematics (CM1) provides a grounding in the principles of actuarial modelling, focusing on deterministic models and their application to financial products. It equips the student with knowledge of the basic principles of actuarial modelling, theories of interest rates and the mathematical techniques used to model and value cash flows which are either certain or are contingent on mortality, morbidity and/or survival. The subject includes theory and application of the ideas to real data sets using Microsoft Excel.

Exam format

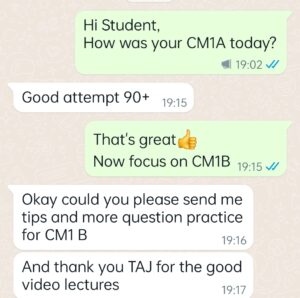

CM1A is 3 hours and 20 minutes exam, CM1B is 1 hour and 50-minutes Excel based exam.

Scientific Calculator is allowed in exam. However, you can use only one of the models from the list below. This can also be used for future exams.

1. Casio FX82 (ES/MS) (with or without any suffix)

2. Casio FX83 (ES/MS) (with or without any suffix)

3. Casio FX85 (ES/MS) (with or without any suffix)

4. Sharp EL531 (with or without any prefix or suffix)

5. Texas Instruments BA II Plus (with or without any suffix)

6. Texas Instruments TI-30 (with or without any suffix)

7. Hewlett Packard HP12c (with or without any suffix)

Detailed Study plan, Chapter Wise Important Topics Detailed description- main highlights.

Exclusive writing and discussion sessions oriented to past papers discussion.

Regular doubt classes to help you learn technical skills and clear your conceptual knowledge.

Regular contacts with companies and start-ups so as to share your resume and prepare you accordingly for interviews.

In Depth training of excel to prepare for online exam.

CM1 SYLLABUS

1 The basics of modelling (10%)

2 Theory of interest rates (20%)

3 Equation of value and its applications (15%)

4 Single decrement models (10%)

5 Multiple decrement and multiple life models (10%)

6 Pricing and reserving (35%)

In the CM subjects, the approximate split of assessment across the three skill types is 20% Knowledge, 65% Application and 15% Higher Order skills.