An actuarial science degree requires thousands of pounds, hundreds of study hours, and multiple tests. Thus, I have a great deal of interest in discovering the answer to the question, “Do actuaries have a future?” You are, I’m sure of it.

As actuarial specialists, we can never be completely sure of what the future will bring. For half a year? A year? Five years, really? Who can say?

However, that’s just what we want to do and what makes us who we are. to estimate, forecast, and predict.

I imagine what the future might hold in this composition. Will actuaries play the same responsibilities as they do now?

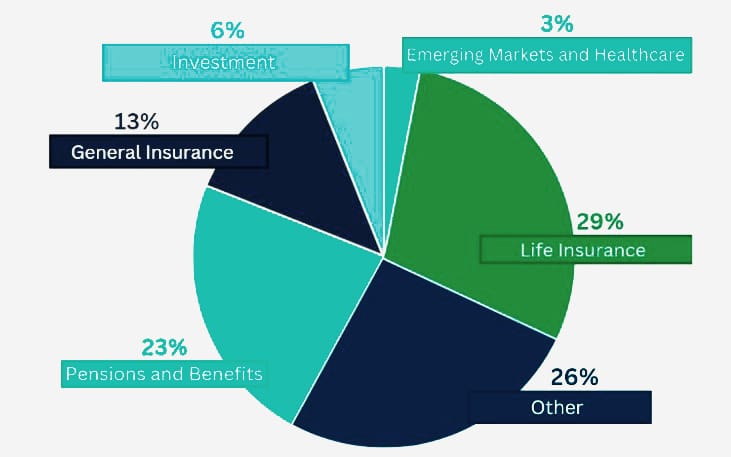

In the UK, 13,000 members of the Institute and Faculty of Actuaries are employed in a variety of fields. The following pie chart illustrates that most actuaries are employed in the life insurance, general insurance, and pension industries, as would be expected.

The field is completed by the healthcare, investing, and other areas like government, banking, and risk management. Consultants may work in any industry. Actuaries are becoming more and more in demand in these unconventional fields, where their transferable skill set is valued for its ability to offer crucial analyses and insights.

The Importance of Adaptability in the Actuary Profession

Day-to-day duties for an actuary typically involve pension plan evaluation, product pricing, actuarial consulting, and reservation. Even though these positions demand a strong foundation in actuarial knowledge, most actuaries would concur that some tasks are repetitious and might be simplified.

These monotonous jobs and processes are increasingly being automated thanks to technological developments, and this trend is probably going to continue. This will free up actuaries’ time to focus on higher-value duties like analyzing and interpreting data and giving clients useful input, as opposed to doing repetitive labor. So, rather than just “crunching the numbers,” actuaries will have a bigger and more meaningful impact in the workplace in the future.

Additionally, machine learning and artificial intelligence are developing quickly. These developments are probably going to change the function of the actuary by enabling humans and machines to collaborate. It’s interesting to note that 17% of worldwide CEOs surveyed by Deloitte believe they are equipped to manage a workforce that combines AI, robots, and humans. In the upcoming years, will this percentage increase? It is something to be very aware of.

As their previous jobs become obsolete, actuaries must adapt and assume new dynamic roles. I predict that in the next years, the job description of an actuary will seem considerably different due to the emergence of a new field of employment. In order to stay up with the times, actuaries will need to have a “growth mindset” and never stop learning and evolving. Future actuaries will need to be innovative and adaptable to succeed, as the biggest opportunities are probably going to lie outside of the traditional actuarial field.

Furthermore, actuaries will need to employ softer skills like good communication as they expand into these other fields and maybe into professions that include more direct client interaction. As more “behind-the-scenes” work is handled by technology, sharing ideas with non-technical audiences will become more in-demand and highly valued.

Learn More : https://theacademicjunction.co.in/

The Role of Actuaries in the Future

‘The Evolving Role of the Actuary‘ is a research project that Actuartech and Montoux conducted throughout 2020.

Two key questions were addressed in this study:

The initial investigation yielded intriguing findings and offered a glimpse into the potential future function of actuaries. Actuaries from all across the world took part in the study. According to respondents, traditional roles in the future will emphasize integrating data science, particularly in big data analysis, experience analysis, and risk management. The respondents also anticipated that actuaries will venture into non-traditional fields like climate change analysis, insurtech, and technology design and growth.

Insurtech is one of the non-traditional fields that is listed. As businesses reconsider how insurance is provided and premiums are determined, insurtech is completely changing the way insurance risk is managed. Insurtech businesses provide personalized policies, dynamically price premiums using gadgets like cellphones, and are always creating new products to launch. In the upcoming years, insurtech may cause a significant change in the insurance sector and the function of actuaries.

The insurance sector will continue to change in a future where innovations like blockchain, quantum computing, driverless cars, and space exploration are commonplace. Every new technology advancement will have a unique effect on insurance, mortality, and even pensions. Actuaries will therefore need to continuously adapt in order to come up with fresh, original answers to problems that come up.

Click to explore : https://theacademicjunction.co.in/what-is-an-actuarial-science/

Consider autonomous cars as an example. As they grow more practical, businesses will run into a number of problems, such as liability, risk management, and risk assessment. Just consider how challenging it may be for insurance companies to determine who is at fault in a collision involving an autonomous car. If the car isn’t fully automated, who is at fault—the driver, the automaker, or the company that provides the software tools that make automation possible?

Therefore, when these issues emerge, actuaries make a great choice for analysis and problem-solving.

The insurance sector will undergo much more transformation as a result of other new threats and issues like pandemics, economic crises, population aging, and climate change. In these domains, actuaries will be indispensable in the future.Consider the COVID-19 pandemic. The insurance sector has unavoidably changed and will continue to do so. It will most likely lead to an overhaul of insurance models and policy terms and conditions, as well as a stronger emphasis on introducing innovative technology.

The Future of Actuaries : Key Trends and Predictions

Actuaries, in my opinion, will be in the forefront of developing new models, technologies, and regulations to assist reduce the risks indicated. Therefore, in order for actuaries to take the lead in offering counsel and guidance, it will be essential for them to pursue ongoing professional development in order to become skilled in these new fields.

As I consider the endless opportunities that actuaries will have in a world that is changing quickly, I can’t help but consider the higher risk of tragedy that comes along with these developments and our reliance on technology. This is emphasized by the example that follows.

NASA launched the Space Shuttle Challenger in January 1986. After takeoff, the shuttle broke apart 73 seconds later. According to NASA’s calculation, the probability of a calamity of that kind is 1/100,000, which translates to a 99.999 percent VAR. But using more basic tests, the engineers calculated the chance at 1/200, or a VAR of 99.5 percent, because they were worried about how the cold might affect O-ring seals. The spaceship and its crew were at risk if the O-rings malfunctioned, as they were classified as a “critical 1” component.

This extreme case emphasizes the value of expert judgment and the potentially fatal effects of relying too heavily on models without human input. It is, in my opinion, a compelling case against those who claim that “technology will take over and actuaries will become redundant.” I believe that as technology develops, actuaries’ duties will become increasingly important in inventing, pricing, and assessing a wide range of insurance products as well as in estimating the costs of new, emerging hazards.

The US Bureau of Labor Statistics projects that employment for actuaries would rise by 18% between 2019 and 2029, disproving the notion that technology will take over the world.

Actuaries, in my opinion, will be in the forefront of developing new models, technologies, and regulations to assist reduce the risks indicated. Therefore, in order for actuaries to take the lead in offering counsel and guidance, it will be essential for them to pursue ongoing professional development in order to become skilled in these new fields.

As I consider the endless opportunities that actuaries will have in a world that is changing quickly, I can’t help but consider the higher risk of tragedy that comes along with these developments and our reliance on technology. This is emphasized by the example that follows.

NASA launched the Space Shuttle Challenger in January 1986. After takeoff, the shuttle broke apart 73 seconds later. According to NASA’s calculation, the probability of a calamity of that kind is 1/100,000, which translates to a 99.999 percent VAR. But using more basic tests, the engineers calculated the chance at 1/200, or a VAR of 99.5 percent, because they were worried about how the cold might affect O-ring seals. The spaceship and its crew were at risk if the O-rings malfunctioned, as they were classified as a “critical 1” component.

This extreme case emphasizes the value of expert judgment and the potentially fatal effects of relying too heavily on models without human input. It is, in my opinion, a compelling case against those who claim that “technology will take over and actuaries will become redundant.” I believe that as technology develops, actuaries’ duties will become increasingly important in inventing, pricing, and assessing a wide range of insurance products as well as in estimating the costs of new, emerging hazards.

The US Bureau of Labor Statistics projects that employment for actuaries would rise by 18% between 2019 and 2029, disproving the notion that technology will take over the world.

All You Need to Know About Actuarial Science by Silky Goyal

Further evidence of the future demand for actuarial services may be found in the article “21 steps for teaching mathematics,” which was submitted to the French Minister of Education in February 2018. According to the paper, “Our world is becoming more and more reliant on artificial intelligence, modeling, digital simulation, process optimization, and massive data processing.” They employ advanced and applied mathematics, which call for a high degree of proficiency.”

Degree programs in actuarial science have frequently placed a strong emphasis on advanced theoretical mathematics while also highlighting its applications. This places actuaries in a strong position to address future complex mathematical issues, with an emphasis on applying and putting into practice practical solutions.

Conclusion:The Future of Actuaries is Bright and Full of Opportunities

So, to conclude. In my opinion…

Will actuaries have a future? Yes.

Will it look very different from right now? I think so.

As Frank Redington, a British actuary best known for his development of Immunisation Theory, once said, “An actuary who is only an actuary is not an actuary.“

So…Learn. Adapt. Grow. Evolve.

Maintaining up with the rapidly evolving technological landscape and thriving in our fast-paced environment are both made possible by ongoing professional development. Actuaries should embrace the many intriguing, non-traditional challenges that lie ahead of them. Jump right in. Together, we can improve the world by utilizing our distinct skill set to effectively manage and reduce emerging threats.

I think actuaries have a bright future ahead of them if they keep learning, growing, and adapting.

I think the following is a more crucial query that you should think about:

Visit Now : https://theacademicjunction.co.in/