Salary of an Actuary in India 2026 – Skill and Experience Required

Actuarial salaries in India are among the highest in the finance domain for several compelling reasons: the profession demands a rare and specialized skill set, requires clearing a series of rigorous, globally benchmarked examinations, and involves high responsibility in managing financial risk for insurance companies and consulting firms.

An actuary’s salary can vary dramatically based on their career stage (student, analyst, associate, fellow), the specific industry they work in (Life, General, Reinsurance), and the advanced skills they bring.

Below, we provide a complete breakdown, including real salary tables and a detailed career roadmap, to give you a clear picture of an actuary’s earning potential.

Know More about Actuarial Science : https://theacademicjunction.co.in/

Actuary Salary in India – Complete Breakdown

Actuarial salaries in India are structured to reward progression, making the career highly lucrative. The compensation increases significantly as candidates clear more exams and gain specialized experience.

Here is how salaries progress based on role, industry, and company type:

| Job Role | Industry Hiring | Company Type (MNC vs. Indian Firm) |

|---|---|---|

| Actuarial Trainee / Analyst | Life Insurance, General Insurance, Health Insurance, Consulting | Both MNCs and Indian firms hire extensively for entry-level roles |

| Senior Actuarial Analyst | Life & General Insurance, Reinsurance, Consulting, Analytics | High demand in MNC GCCs and top Indian insurance companies |

| Actuarial Manager / Actuary | Life Insurance, General Insurance, Consulting, Risk Management | Common in Indian insurers; also found in MNC consulting arms |

| Appointed Actuary / Chief Actuary | Life, General & Health Insurance | Mostly in major Indian + international insurers (IRDAI regulated roles) |

| Risk Specialist / Data Scientist | Consulting, Reinsurance, Analytics, FinTech | Mostly in MNC consulting + analytics hubs; limited roles in Indian insurers |

Actuary Salary in India per Month (Realistic Figures)

Analyzing actuarial science salary per month data helps aspiring actuaries understand the realistic cash flow and budget for their extensive study period. The table below shows the approximate monthly earnings across key career stages.

| Career Stage | Verified Monthly Range (Approx.) |

| Freshers (Entry-Level / Junior Analyst) | ₹30,000 – ₹58,000 |

| Analysts (Mid-Level / Senior Analyst) | ₹50,000 – ₹1,25,000 |

| Associates / Fellows (Qualified Actuary) | ₹1,66,000 – ₹5,00,000+ |

Starting Salary of an Actuary in India

The starting salary of an actuary in India is heavily dependent on the number of actuarial exams cleared.

An actuary average salary is high due to the scarcity of qualified professionals, but initial earnings are tied directly to exam progress.

| Career Stage | Typical Job Title | Expected Salary |

| Beginner (Student Member, 1–2 exams) | Actuarial Analyst / Trainee | ₹4 – ₹7 LPA |

| Mid Exams Cleared (Approx. 4–7 exams) | Senior Actuarial Analyst | ₹8 – ₹15 LPA |

| Associate Status (AIAI) | Actuary / Risk Specialist | ₹15 – ₹30 LPA |

| Fellow (FIAI) | Chief Actuary / Senior Consultant | ₹35 LPA + |

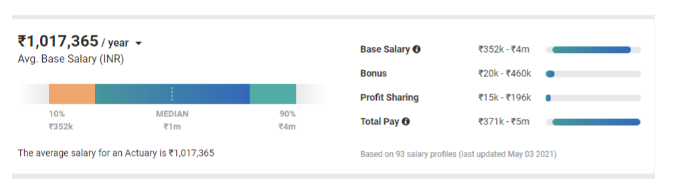

Resources – AmbitionBox

Fresher Salary Expectations

The difference in starting pay is significant:

- ACET-only Candidates: Students who have only cleared the Actuarial Common Entrance Test (ACET) and registered as a student member often start with an internship or trainee role at the lower end of the ₹4–₹7 LPA range.

- Early-Exam Candidates: Students who have cleared 2–3 core exams before starting their job are often hired directly as Actuarial Analysts and can command a salary at the higher end, sometimes exceeding ₹7 LPA, due to the proven commitment and reduction in the employer’s risk. This early effort directly impacts the starting compensation and growth trajectory.

Actuary Salary Levels by Designation

The designation of an actuary is a direct reflection of their exam clearance status, experience, and regulatory ability, resulting in massive differences in salary.

| Designation | Typical Responsibilities | Approx Annual Salary (LPA) | Key Notes |

| Actuarial Analyst / Trainee | Data cleaning, pricing support, valuation assistance, reporting under supervision | ₹4 – ₹10 LPA | Salary depends heavily on exams cleared (1–3) and employer type. |

| Associate Actuary (AIAI) | Handles pricing/reserving modules, leads small projects, mentors juniors | ₹15 – ₹30 LPA | The AIAI status marks a major, regulated salary jump. |

| Fellow Actuary (FIAI) | Regulatory sign-offs, leadership roles, P&L management, ERM, strategic decisions | ₹35 – ₹60 LPA+ | Senior roles, particularly Appointed Actuary, can exceed ₹1 Crore+ annually. |

Actuary Salary by Industry in India

Actuarial careers are available across diverse financial sectors, with compensation varying based on the inherent risk and complexity of the domain.

| Industry | Entry-Level (0–3 yrs) | Mid-Level (4–10 yrs) | Senior / Fellow (10+ yrs) |

| Life Insurance | ₹4.5 – ₹11.5 LPA | ₹15 – ₹41 LPA | ₹40 LPA – ₹1 Crore+ |

| General Insurance | ₹4 – ₹12 LPA | ₹12 – ₹30 LPA | ₹35 LPA – ₹80 LPA+ |

| Health Insurance | ₹4 – ₹11 LPA | ₹12 – ₹30 LPA | ₹30 LPA – ₹60 LPA+ |

| Reinsurance | ₹7.8 – ₹14 LPA | ₹15 – ₹45 LPA | ₹50 LPA – ₹1 Crore+ |

| Pension Consulting | ₹4 – ₹10 LPA | ₹16 – ₹30 LPA | ₹30 LPA – ₹70 LPA+ |

| Data Science / Analytics | ₹7.4 – ₹14 LPA | ₹20 – ₹40 LPA | ₹40 LPA – ₹90 LPA+ |

Sources: AmbitionBox, Glassdoor (salary range aggregation)

Why Some Industries Pay More

- Reinsurance & Analytics: These sectors tend to pay the highest salaries at the entry and mid-levels because they often involve advanced statistical modeling, complex global risks, and high-end MNC consulting work that demands sophisticated quantitative skills.

- Life Insurance: While entry-level pay might be moderate, Life Insurance offers the highest salaries at senior levels (Fellow/Chief Actuary) due to the highly regulated nature of the business and the Appointed Actuary’s regulatory and financial responsibility for long-term liabilities.

Company Wise Salary of an Actuary in India

The salary of an Actuary in India has been analysed in some companies and, the average annual salary of an actuary in India is 16 lacs, with a minimum salary range beginning at 6.50 lacs.

| Company Name | Actuary Average Salary |

| Infosys | 6.50 LPA |

| Deloitte | 7.72 LPA |

| Ernst & Young | 9.36 LPA |

| HCL Technologies | 9.20 LPA |

| Swiss Re | 16 LPA |

| Oracle | 8.10 LPA |

| Genpact | 8.36 LPA |

| Mckinsey & Company | 28.33 LPA |

Sources: AmbitionBox , Glassdoor (salary range aggregation)

Actuarial Science Salary in India by Qualification

The salary for those pursuing an actuarial science course is directly and linearly tied to the number of exams cleared. The value of an individual increases with every paper passed, especially once the Associate (AIAI) and Fellow (FIAI) milestones are reached.

| Qualification Stage | Typical Job Title(s) | Annual Salary Range (LPA) |

| ACET / Student Membership | Intern, Trainee, Actuarial Analyst | ₹3.5 – ₹7.5 LPA |

| 1–3 Exams Cleared | Actuarial Analyst, Actuarial Executive | ₹4.5 – ₹14 LPA |

| 4–7 Exams Cleared | Senior Actuarial Analyst, Lead Analyst | ₹8 – ₹25 LPA |

| Associate (AIAI) | Actuarial Associate, Actuarial Consultant | ₹15 – ₹30 LPA |

| Fellow (FIAI) | Fellow Actuary, Chief Actuary, Director | ₹35 LPA – ₹1 Crore+ |

Sources: AmbitionBox , Glassdoor (salary range aggregation)

This progression shows that the effort invested in the rigorous exams directly translates into an exponential earning curve, making the actuarial science salary per month a function of the professional’s commitment to qualification.

How to Become an Actuary in India

Becoming an actuary is a highly structured, self-paced professional path that is governed by the Institute of Actuaries of India (IAI). If you follow the right sequence—student membership, core exams, specialization, and work experience—you progress steadily toward the Fellow Actuary (FIAI) designation.

Step 1 — Register as a Student Member (After ACET)

- Clear the ACET (Actuarial Common Entrance Test).

- Apply for Student Membership under the Institute of Actuaries of India (IAI).

- Get access to exams, study material, and official resources.

- Begin internships or entry-level work if possible to gain exposure.

Step 2 — Clear Core Exams Strategically (CM, CS & CB)

These three groups (9 papers) build your essential foundational knowledge.

- CM (Core Mathematics): Focuses on Financial mathematics and statistical modelling. Builds skills in quantitative reasoning and model-building.

- CS (Core Statistics): Focuses on Data analytics, probability, and inference. Builds skills in programming and statistical analysis.

- CB (Core Business): Focuses on Finance, economics, and business risk. Builds business understanding and decision-making frameworks.

Step 3 — Choose Your Specialization (SP & SA)

- Select SP (Specialist Principles) papers based on your preferred domain (Life, Health, Pensions, GI, Investment, etc.).

- Attempt the SA (Specialist Advanced) paper, which is the final specialization paper. This stage critically influences your long-term career track and expertise.

Step 4 — Gain Work Experience (This Matters as Much as Exams)

- Start working in actuarial teams for roles like valuation, pricing, modeling, and consulting.

- Apply theoretical concepts to real-world data and business problems.

- Build essential technical tools (e.g., R, Python, Excel VBA, SQL). Experience combined with exams is the key to faster progression toward Associate → Fellow status.

Actuarial Career Scope & Salary Growth in India

Actuarial Career Scope in India

The scope for actuarial careers in India is currently on a strong upward trajectory:

- Rising Demand: There is a persistent talent shortage of fully qualified actuaries against a growing financial sector.

- Expanding Opportunities: Opportunities are continuously expanding beyond traditional Life and General Insurance into consulting, health tech, and the broader BFSI (Banking, Financial Services and Insurance) sector.

- Key Roles: There is a strong, growing need for actuaries in core areas like pricing, valuation, and risk modelling.

- Outlook: The scope is expected to grow for the next 10+ years with industry expansion, making it one of the high salary courses after 12th.

Actuarial Salary Growth in India

Actuarial salary growth is characterized by distinct, high-impact jumps:

- Exam-Driven Growth: There is a clear salary jump with the clearance of every significant exam milestone.

- Status Hike: A significant hike occurs once a student member enters the Associate/Fellow levels due to the regulatory value of the designation.

- Exponential Earning Curve: The combination of Experience + Exams creates an exponential earning curve, ensuring that mid-senior actuaries rank among the highest-paid finance professionals in India.

Courses to explore in Actuarial Science

ACET + Pre Actuarial Refresher Programme

Original price was: ₹20,000.00.₹10,000.00Current price is: ₹10,000.00.Pre Actuarial Refresher Programme

Original price was: ₹12,000.00.₹5,000.00Current price is: ₹5,000.00.Basic R

Original price was: ₹4,000.00.₹2,000.00Current price is: ₹2,000.00.CB1

₹10,000.00 – ₹13,500.00CB1 (Full English Course)

Original price was: ₹25,000.00.₹20,000.00Current price is: ₹20,000.00.CB1 + CB2

₹18,000.00 – ₹25,000.00CB1 Test Series

Original price was: ₹7,000.00.₹4,000.00Current price is: ₹4,000.00.CB2

₹10,000.00 – ₹13,500.00CB2 (Full English Course)

Original price was: ₹25,000.00.₹20,000.00Current price is: ₹20,000.00.CB2 Test Series

Original price was: ₹7,000.00.₹4,000.00Current price is: ₹4,000.00.CM1

₹23,000.00 – ₹27,500.00CM1 (Full English Course)

Original price was: ₹40,000.00.₹35,000.00Current price is: ₹35,000.00.Skills That Increase an Actuary’s Salary

While an actuary is expected to have a strong quantitative background, certain skills are highly valued by employers and directly contribute to higher salary offers:

Technical Skills

- Statistical Modeling: Building and interpreting complex models (e.g., GLMs, time series) for pricing and reserving.

- Risk Modeling: Understanding and quantifying financial, operational, and insurance risks (ERM – Enterprise Risk Management).

- Programming: Proficiency in languages like R, Python, and SQL for data manipulation and automation.

- Insurance Domain Knowledge: Deep understanding of specific product lines (e.g., ULIPs, Motor Insurance, Catastrophic risk).

Soft Skills

- Analytical Thinking: The ability to decompose complex problems into manageable parts.

- Clear Communication + Reporting: Translating highly technical model results into clear, actionable business insights for non-technical stakeholders (crucial for leadership roles).

- Problem-Solving: The ability to think creatively to find solutions when models fail or data is incomplete.

- Attention to Detail: Absolute accuracy is paramount in regulatory reporting and financial valuation

FAQ’s

1. What is actuarial science?

Actuarial science is a discipline that uses mathematical, statistical, and financial theory to study uncertain future events, primarily concerning insurance and finance. It involves modeling risk, analyzing data, and assessing the financial impact of risk on an organization.

2. Define actuary

An actuary is a business professional who is trained in the practical application of actuarial science. They assess and manage the financial risks of future events, most commonly in the insurance and pension industries, using advanced mathematical and statistical methods.

3. Is actuarial science a good career?

Yes, actuarial science is considered an excellent career choice. It offers high earning potential, intellectual challenge, strong job security due to constant regulatory demand, and diverse actuarial careers across various financial sectors.

4. What is the salary growth for actuaries?

Salary growth is exponential and directly tied to passing professional exams. The biggest jumps occur after clearing core papers, achieving the Associate status (AIAI), and finally reaching the Fellow status (FIAI), where senior-level compensation can be among the highest in India.

5. How long does it take to become an Actuary?

On average, it takes 6 to 10 years of dedicated study and work experience to achieve the Fellow Actuary (FIAI) status, though the path is self-paced. The first few exams can often be cleared in the initial 2 to 3 years.

6. Why should I consider the actuarial profession?

You should consider the actuarial profession if you enjoy advanced mathematics, have a strong interest in business and finance, are highly disciplined, and seek a career that offers continuous intellectual growth and exceptional financial rewards.

7. Will I need to continue training once I have qualified?

Yes, all qualified actuaries must engage in mandatory Continuing Professional Development (CPD) to maintain their Fellow status and stay updated with the latest regulatory changes, valuation standards, and modeling techniques.