Blog

Definitive Guide to CP2 (Modelling Practice)

Actuarial science is a field that assesses and evaluates an organisation’s risks and looks for potential ways to eliminate or lessen them. Actuarial Science has evolved into one of the most difficult careers because it aids in the resolution of significant financial issues that affect an organisation.

CP2 Modelling Practice

The aim of the CP2 Modelling Practice subject is to ensure that the chosen candidate is capable of modelling data, documenting their work (including maintaining an audit trail for a fellow colleague), analysing the methodologies used and the results obtained, and communicating their plan, results, and conclusions to others. This online test is designed to test your knowledge of how to model data, document your work, which includes establishing an audit trail, examine the methods you used and the results you obtained, and communicate them to an actuarial audience along with your conclusions. You must be comfortable using spreadsheets and Word.

The CP2 Modelling Practise subject aims to ensure that the successful candidate can model data, document the work (including maintaining an audit trail for a fellow colleague), analyse the methodologies used and the outputs produced, and communicate the approach, outcomes, and conclusions to colleagues.

The Format of CP2

- The online exam will consist of two three hours and fifteen minute long papers that will be given on the same day. Both papers will be written using Microsoft Office 2007 on a PC.

- Students will be given a problem to model in Paper 1 along with data to examine and an audit trail. Students will submit summaries in Paper 2 that include the following elements: description, approach, findings, and conclusions.

- There won’t be an audience for this.

- Your computers will have a soft copy of the pertinent core reading.

- The CP2 test will be administered in a classroom setting under the watchful eye of an invigilator.

- In addition to the Regular Examination, the CP2 examination will only be offered in centres in India twice a year. Students can see these when they sign up for the test. There is no restriction on batch size for registration.

- You will need to buy your own study materials.

- To pass the test, students must take it in its entirety and pass both sections; otherwise, they will earn an overall absent rating.

Registration for CP2 Modelling Practice will not require the passing of any prior exams.

Competences & Skill levels

After successfully completing this course, the applicant will be able to:

- Gather and summarise data; do exploratory data analysis; and engage in data visualisation.

- Build an actuarial model to address a real-world issue.

- By creating an audit trail, you can document the model.

- Analyse the procedures followed and results produced.

- Deliver the findings.

Skill levels:

A syllabus objective’s use of a particular command verb does not mean that this is the sole way to inquire about the subject matter covered by that objective. Any of the approved command verbs, as listed in the document “Command verbs used in the Associate and Fellowship written examinations,” may be used by the Examiners to pose a question on any subject covered by the curriculum.

Questions may be set at any skill level: Knowledge (demonstration of a thorough knowledge and understanding of the topic), Application (demonstration of the ability to apply the underlying principles of the topic within a given context), and Higher Order (demonstration of the ability to perform deeper analysis and assessment of situations, including forming judgements, taking into account different points of view, comparing and contrasting situations, and suggesting possible solutions).

20% Knowledge, 50% Application, and 30% Higher Order skills are roughly the three skill types assessed in the CP2 Modelling Practice.

Links to other subjects

- The principles covered in CM1 and CM2 are expanded upon in this topic. Additionally, it may draw from CS1 and CS2 content.

- The concepts from CP1 and some of the developments in communications from CP3 are also applied to this topic.

Syllabus topics

- Preparation and exploratory analysis of data (10%)

- Development of a model with clear documentation (30%)

- Analysis of methods and model outputs (15%)

- Application and interpretation of results (20%)

- Communication of results and conclusions (25%)

These weightings represent the averaged over a number of examination sessions assessment of this subject between the major themes on the curriculum.

Additionally, each syllabus topic’s weightings correspond to the amount of supporting readings. This will, however, also take into account factors like:

- The relative complexity of each issue, and thus, the quantity of justification and support needed for it.

- the extent of prior knowledge that is expected;

- the requirement to give comprehensive foundation understanding on which to develop the other objectives.

- the proportion of each subject matter that is more knowledge- or application-based.

Actuarial Science CP2 Playlist

Exam fees:

| SR. NO. | SUBJECT | FOR INDIA AND SAARC COUNTRIES (INR) | FOR OTHER THAN SAARC COUNTRIES (INR) |

| Core Principles | |||

| 1 | CS1 – Actuarial Statistics | 5000 | Not Applicable |

| 2 | CS2 – Risk Modelling and Survival Analysis | 5000 | Not Applicable |

| 3 | CM1 – Actuarial Mathematics | 5000 | Not Applicable |

| 4 | CM2 – Financial Engineering and Loss Reserving | 5000 | Not Applicable |

| 5 | CB1 – Business Finance | 3000 | 7500 |

| 6 | CB2 – Business Economics | 3000 | 7500 |

| 7 | CB3 – Business Management | 10000 | 10000 |

| Core Practices | |||

| 8 | CP1 – Actuarial Practice | 8000 | 20000 |

| 9 | CP2 – Modelling Practice | 10000 | Not Applicable |

| 10 | CP3 – Communications Practice | 8000 | 20000 |

| Specialist Principles Stage (SP) | |||

| 11 | SP1 – Health and Care | 6000 | 15000 |

| 12 | SP2 – Life Insurance | 6000 | 15000 |

| 13 | SP4 – Pension and Other Benefits | 6000 | 15000 |

| 14 | SP5 – Investment and Finance | 6000 | 15000 |

| 15 | SP6 – Financial Derivatives | 6000 | 15000 |

| 16 | SP7 – General Insurance Reserving and Capital Modelling | 6000 | 15000 |

| 17 | SP8 – General Insurance – Pricing | 6000 | 15000 |

| Specialist Advanced Stage (SA) | |||

| 18 | SA1 – Health and Care | 7500 | 18750 |

| 19 | SA2 – Life Insurance | 7500 | 18750 |

| 20 | SA3 – General Insurance | 7500 | 18750 |

| 21 | SA4 – Pension and Other Benefits | 7500 | 18750 |

| 22 | SA7 – Investment and Finance | 7500 | 18750 |

Exam Center:

| Code | Center Name | Code | Center Name |

| 1 | Mumbai | 9 | Jaipur |

| 2 | Delhi | 10 | Ahmedabad |

| 3 | Kolkata | 11 | Lucknow |

| 4 | Bangalore | 12 | Chandigarh |

| 5 | Gurgaon | 13 | Indore |

| 6 | Chennai | 14 | Kochi |

| 7 | Pune | 15 | Coimbatore |

| 8 | Hyderabad | 16 | Guwahati |

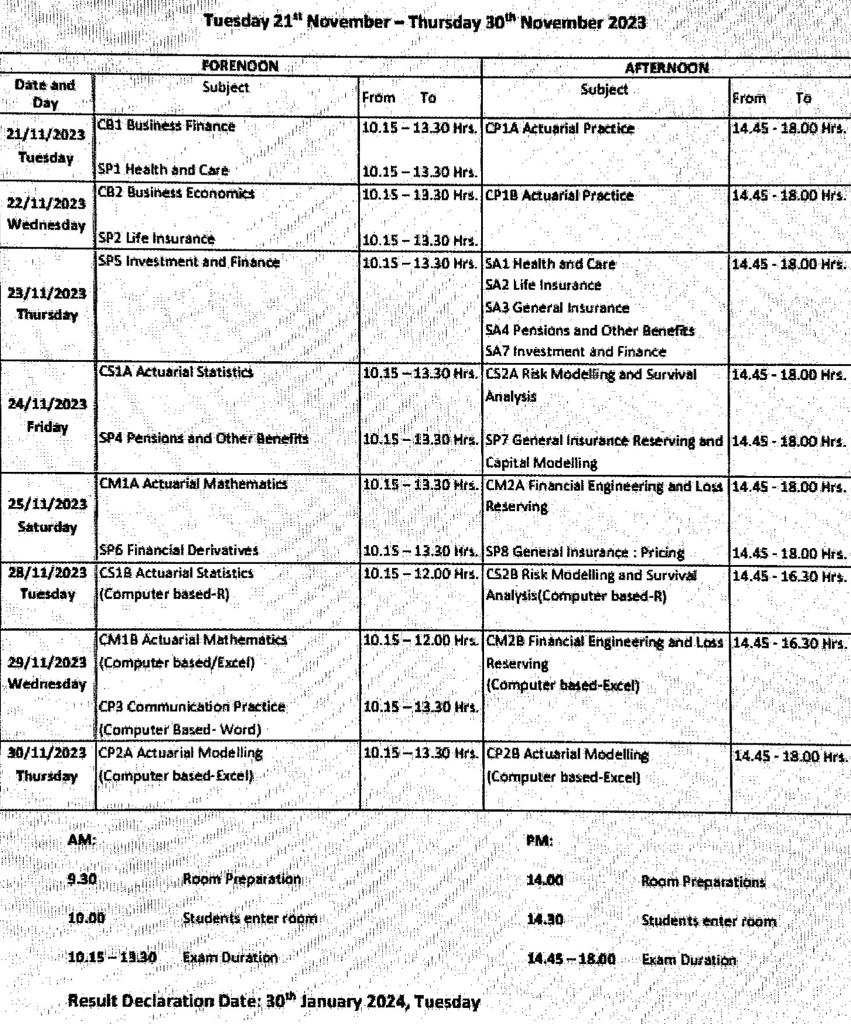

Examination Dates

Conclusion

A major focus of CP2 Modelling Practice is effective communication while using and presenting spreadsheet work. It builds on content from preceding classes and aims to give students more ’rounded’ business abilities. The Academic Junction wants to help you at every stage of your career so that you can acquire or improve the information, abilities, and traits necessary for both the present-day and actuarial practice’s foreseeable future needs. We are putting our pupils through superior education, developing their analytical and problem-solving abilities, and teaching them how to prosper in the global economy. We promise to give students an excellent education, a guarantee of employment, and a life that is worthwhile. In India, we are the top instructors for coaching in actuarial science.

Frequently Asked Questions

To give you an idea of how difficult the exams are, the pass rates for the latter exams, with the exception of a few, typically fall below 50%. In actuality, the pass rates for the tests in April 2020 were as follows: CP1: 44.5% | CP2: 65.7% | CP3: 50.3% CB1: 59.6% | CB2: 70.7%

CP2 is an online test with two papers that last three hours and fifteen minutes each. It is given on the same day.

CP2 is an online examination consisting of two papers of duration three hours fifteen minutes each conducted on the same day. CP1-Actuarial Practices. CP2-Modelling Practice. CP3-Communications Practice.